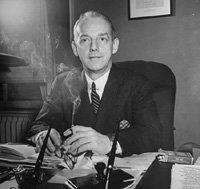

Randolph E. Paul, Visiting Sterling Lecturer, 1937-43

Randolph E. Paul

REFERENCES:

Photograph courtesy of Tax History Project.

“Historical Perspective—Profiles in Tax History: Randolph E. Paul,” (Oct. 6, 2004).

“Randolph E. Paul, Lawyer and Tax Expert, Elected to the Board of Federal Reserve Here,” N.Y. Times, June 13, 1941, at 29.

“Randolph E. Paul Dies at Hearing,” N.Y. Times, Feb. 7, 1956, at 19.

“Randolph Paul,” Wash. Post (op.ed.), Feb. 7, 1956, at 22.

Randolph Paul (1890-1956) was one of the architects of the federal income tax. An advocate of the expansion of federal taxes during World War II, he served first as an informal advisor to the Treasury Department on tax issues in the late 1930s and early 1940s. He assumed a full time position after the attack on Pearl Harbor, becoming General Counsel to the Treasury in August 1942. During the years when he was lecturing at the Law School, in addition to engaging in private tax practice, serving as a director of the Federal Reserve Bank in New York and providing advice to the Treasury Department, he published a series of influential works on federal taxation, including Studies in Federal Taxation (1937, 1938, 1940), and Federal Estate and Gift Taxation (1942). As Treasury General Counsel, he advocated a broad income tax, both as a revenue producer to finance the war effort, and as a tool for regulating the economy. He contended that an income tax expanded to include the middle class was more equitable, as well as more reliable as a revenue stream to meet war needs, than a national sales tax, an alternative being promoted by members of Congress, among others, at the time.

In 1944, Paul left the Treasury Department to found the New York law firm Paul, Weiss, Rifkind, Wharton & Garrison. Although Paul did not resume his association with the Law School, he continued to publish scholarly works on tax issues, including Taxation for Prosperity (1947), in which he argued in favor of progressive taxation, and Taxation in the United States (1954), a history of federal taxation, in which he further developed his advocacy of a broad progressive income tax and its superiority to alternative taxes. He died while testifying at a congressional hearing on then President Eisenhower’s tax and budget policies, which he considered inequitable. In an obituary the following day, the Washington Post praised Paul, stating that “He saw fiscal issues in the large context of the national economy, and with the understanding of an economist and social planner.”